1.What is open item management?

Open item management means that a line item needs to be cleared against another open item. At a particular point, the balance of an account is the sum of all open items of that account. Generally, you make these settings in the G/L Master for all clearing accounts, such as a Goods receipts and Invoice receipts (GR IR) account, customer account, vendor account, or bank G/L account, or all accounts except the main bank account. Open item managed accounts always have line item management.You can switch open item management on and off through transaction code FS00.

2.What are the types of currencies?

The following currencies are used in SAP solutions:

■ Local currency—T his is company code currency, which is used for generating financial statements for external reporting. Sometimes it is called operating currency.

■ Group currency —Group currency is the currency that is specifi ed in the client table and used for consolidation purposes.

■ Hard currency —Hard currency is a country-specifi c second currency that is used in countries with high infl ation.

■ Index-based currency —Index-based currency is a country-specific fictitious currency that is required in some countries with high infl ation for external reporting (for example, tax returns).

■ Global company currency —Global company currency is the currency that is used

for an internal trading partner.

3.Are any FI documents created during purchase order (PO) creation? If

yes, what is the entry?

During PO creation (using transaction code ME21N), no FI document will be created. However, in CO, there can be a commitment posting to a cost center according to confi guration. The offsetting entry is posted at the time of GR.

4.There are many banks in a house bank. If a payment is to be made from a particular bank G/L account, how is it carried out?

There can be several accounts in one house bank. A house bank is represented by a house bank ID and a bank account is represented by an account ID. While creating the account ID, you are assigning a G/L account for outgoing payment. When making payment, you will select the house bank ID and account ID, which in turn determines from which G/L account payment will be disbursed.

5.What is the difference between Account Assignment Model (AAM), recurring entries, and sample documents?

AAM: A reference for document entry that provides default values for posting business transactions. An AAM can contain any number of G/L account itemsand can be changed or supplemented at any time . Unlike sample documents, the G/L account items for AAMs may be incomplete.

Recurring entries : A periodically recurring posting will be made by the recurring entry program on the basis of recurring entry original documents. The procedure is comparable to a standing order by which banks are authorized to debit rent payments, payment contributions, or loan repayments.

Sample documents : A sample document is a special type of reference document. Data from this document is used to create default entries on the accounting document entry screen. Unlike an accounting document, a sample document does not update transaction fi gures but merely serves as a data source for an accounting document.

6.In the G/L master you have the options Only balances in local crcy and Account currency. What do these mean?

Account currency is the currency assigned to the G/L account. If you decide that you want to maintain company code currency, then you can post a transaction in any currency in that account. If you want to maintain separate currency for that G/L, note that there will be a difference because of the conversion rate. Some G/L accounts can’t be maintained on an open item basis and can’t be in a foreign currency, such as clearing accounts or discount accounts, etc. In that case,you can specify Only balances in local crcy to show the balance in local currency.

7.How many charts of account can be attached to a company code?

A maximum of three charts of account can be assigned to a company code:

- operational COA

- group COA

- country COA.

8.What are substitutions and validations? What is the precedent?

Validations are used to check the presence of certain conditions. It returns a message if the prerequisite check condition is not met. Substitutions are similar to validations. They actually replace and fi ll the field with values behind the scenes without the user’s knowledge, unlike validations that create on-screen messages for the user.

9.What are special periods used for?

The special periods in a fi scal year variant can be used for posting audit or tax adjustments to a closed fi scal year. The logic behind the use of special periods is to identify and have control over transactions after the closing of normal posting periods.

10.What is a shortened fiscal year? When is it used?

A shortened fi scal year is a fi nancial year that has fewer than 12 normal posting periods. This type of fi nancial year is used for shifting an accounting period from one fi nancial period to another fi nancial period. For example, say Company X was following accounting period Apr xxxx to Mar xxxx+1, and has now decided to follow accounting period Jan xxxx to Dec xxxx. Now the current accounting period duration is only 9 months, i.e., from Apr xxxx to Dec xxxx, which is less than12 months. This type of fi scal year is called a shortened fi scal year.

11.What are posting periods?

A posting period is a period of time in which you are posting a transaction. It may be a month or a week. In the fi scal period confi guration, you defi ne how many posting period a company may have. A posting period controls both normal and special periods for each company code. It is possible to have a different posting period variant for each company code in the organization. The posting period is independent of the fiscal year variant.

12.What are document types and what are they used for?

Document type is nothing but types of vouchers containing line items. Several business transactions can be identifi ed within a particular document type. The document type controls:

■ Document number ranges

■ Header part of document

■ Line item level of the document

■ Filing of physical document

However, if SAP standard document types are not suffi cient, you can create your own using transaction code OBA7.

13.What is an employee’s tolerance group? Where is it used?

An employee’s tolerance group controls the amount that is to be posted. Tolerance groups are assigned to user IDs, which ensures that only authorized persons can make postings. By defining the employee’s tolerance group, you are restricting employees from entering certain transactions for which they are not authorized.This basically controls who is authorized for what amount.

An employee’s tolerance group limit controls:

■ Up to what amount per line item an employee can post

■ Up to what amount per document an employee can post

■ Allowable payment difference an employee can accept

14.How many FSVs can be assigned to the company code?

There is no such restriction of assignment of FSV to company codes. You can assign as many FSVs as you want to the company code.

15.What are recurring entries and why are they used?

Recurring entries (setup in FBD1 ) can eliminate the need for the manual posting of accounting documents

which do not change from month to month. For example, a regular rental expense document can be created which can be scheduled for the last day of each month. Usually multiple recurring entries are created together and then processed as a batch at month end using transaction F.14

16.Explain how foreign currency revaluation works in SAP R/3 FI

Over time the local currency equivalent of foreign currency amounts will fluctuate according to exchange rate

movements. Usually at month end, there is a requirement to restate these amounts using the prevailing month end exchange rates.

SAP can revalue foreign currency GL account balances as well as outstanding customer and vendor open item balances.

In SAP configuration, you define the balance sheet adjustment account and which accounts the realized gain/loss should be booked.

A batch input session is created to automatically post the required adjustments.

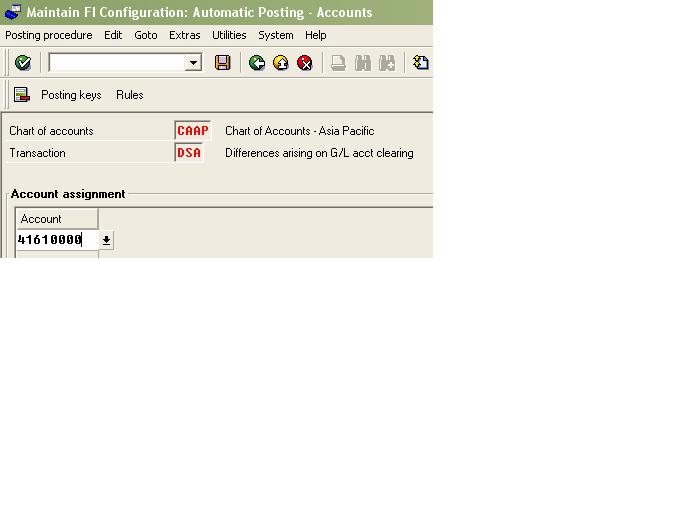

17.During GL account clearing how can small differences be dealt with ?

During configuration a tolerance limit is set which defines the maximum differences allowed during clearing.

The differences can be automatically booked by the system to a specific account during posting (using IMG transaction OBXZ)

18.A general ledger master record contains …….TWO……….. segments