Foreign Currency Transactions:

There are Three types of exchange rates defined by step:

- Bank Buying Rate Exports Purpose ⇒G Type

- Bank Selling Rate Imports/Expenditure ⇒B Type

- Average Rate MM/SD Users only ⇒M Type

When posting and clearing documents, the system uses the exchange rate type “M” for foreign currency translation. This exchange rate type must be contained in the system.

Steps:

⇒ Find out which exchange rate types are needed in your company.

⇒ Check the standard exchange rate types. Create additional exchange rate types if necessary.

⇒ If you want to specify that all currency translations for a rate type must be carried out using a base currency, enter a currency (such as the group currency) in the Base cur field.

⇒ If you want to use the base currency specified as the From-currency, select the BCurr=from field.

⇒ If you want to have the system calculates the buying and selling rates from the average rate and the spread, enters the rate type for the average rate in the Buy.rt.to or Sell.rt.to field. Then maintain the spreads under the activity Maintain spreads.

⇒ If you want to use the inverted rate for translating two currencies, select the Inv field.

Note: The reversed rate is used only if you have not made an entry for the corresponding exchange rate in the activity Enter exchange rates.

⇒ If you want to calculate the amounts according to the European Monetary Union’s legal directives, select the EMU field.

⇒ If you want the system to check whether the application uses an exchange rate other than the fixed exchange rate, select the indicator in the Fixed field.

This indicator must be set for the exchange rate type that is used for currency translation within the EMU.

Exchange rate difference can be defined as the amount arising where a foreign currency amount is translated at different exchange rates.

Here, we can define for each company code, a maximum difference between exchange rates for postings in foreign currency.

For this, we mention that how much the exchange rate entered manually in the document header may differ in terms of percentage (%) from the one stored in the system.

If an exchange rate or the local and the foreign currency amount were entered manually during document entry, then a comparison is made with the exchange rates stored in the system. If any deviation occurs and it exceeds the percentage rate specified here, then a warning appears.

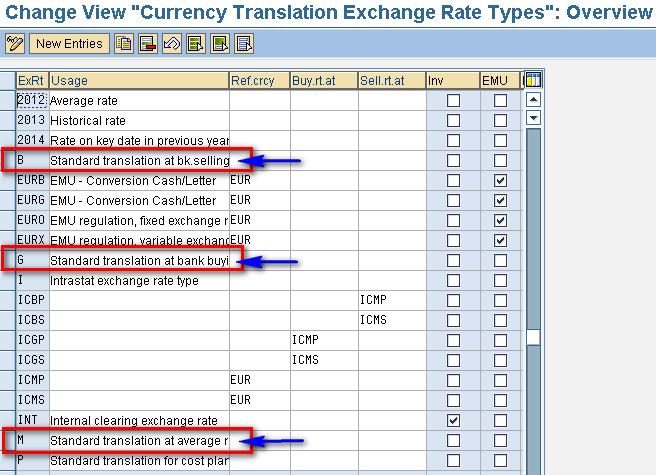

Check Exchange rate types:

Path: SPRO ⇒ SAP Net weaver⇒ General Settings ⇒ Currencies ⇒ Check Exchange rate types

Make sure the B, G & M are defined under Check exchange Rate types.

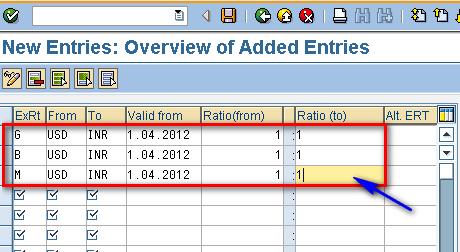

Define Translation Ratios for Currency Translation:

⇒ Once we follow one conversion Factor, follow continuously for all the years, don’t change in between, it gives wrong results.

⇒ Conversion factors are given at Client level but not at Company code level

Path: SPRO ⇒ SAP Net weaver⇒ General Settings ⇒ Currencies ⇒Define Translation Ratios for Currency Translation

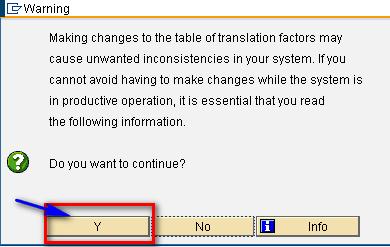

Read the following Warning message,

Click on “Y”

Then click on “New Entries”

- Configure as shown above for G, B and M

- Click on “Save”

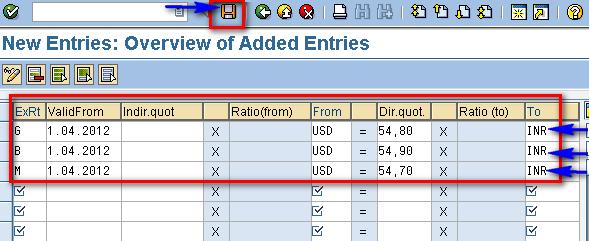

Enter Exchange Rates:

This is called Forex table. We can enter Foreign Exchange rates Daily, Weekly, Monthly, for each type we can enter only one rate in a day.

Exchange rates are required to:

- Translate foreign currency amounts when posting or clearing or to check an exchange rate entered manually

- Determine the gain and loss from exchange rate differences

- Evaluate open items in foreign currency and the foreign currency balance sheet accounts

The system uses the type M exchange rates for foreign currency translation when posting and clearing documents in the activity Enter Exchange Rate. An entry must exist in the system for this exchange rate type. The exchange rates apply to all company codes.

Path: SPRO ⇒ SAP Net weaver⇒ General Settings ⇒ Currencies ⇒ Enter Exchange Rates

Enter Exchange Rates as shown above and then click on “SAVE”

Foreign Currency postings for End User area:

⇒ When exchange rate is not entered at the time of posting the Document.

⇒ When exchange rate is entered at the time of posting the Document.

1. When exchange rate is not entered at the time of posting the Document:

- It takes rate from Forex Table.

- It takes the latest date rate.

Eg: on 15.03.2013 Rate is 54.40 INR

On 22.03.2013 Rate is 55.60 INR

If we want to enter document on 20.03.13, system will take the rate of 54.40/INR not 55.60/INR

- Enter default Exchange rate type based on Document Type.

| Doc. Type | Nature of Doc | Type of Ex Rate |

| SA | General Ledger Posting | B Bank Selling Rate |

| KR | FI Purchase Invoice posting | B |

| RE | MM Purchase Invoice posting | B |

| DR | FI Sale invoice posting | G Bank Buying Rate |

| RV | SD Sale invoice posting | G |

Note: If we do not specify system will take average rate type ”M”

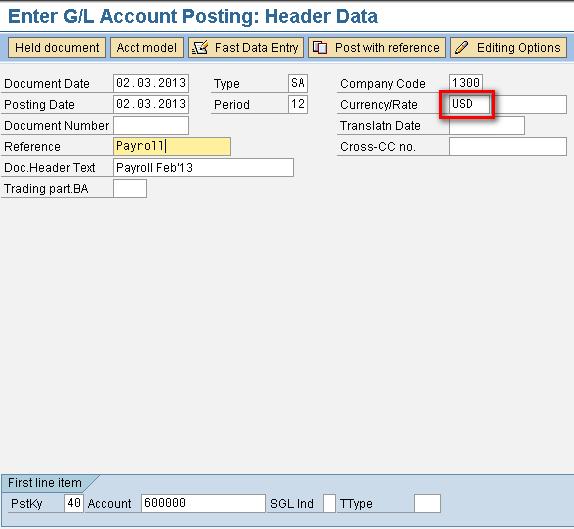

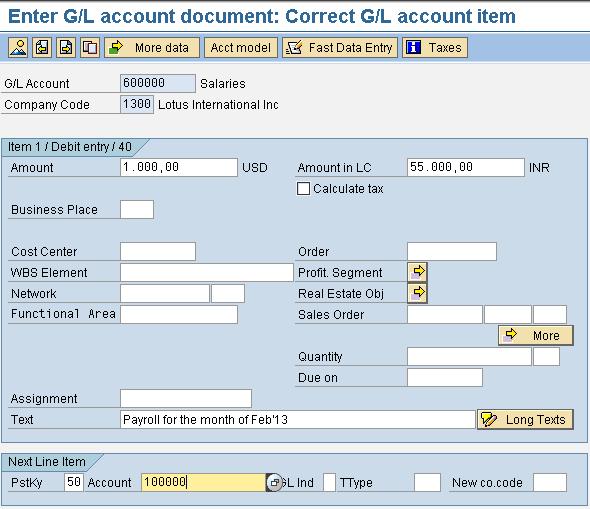

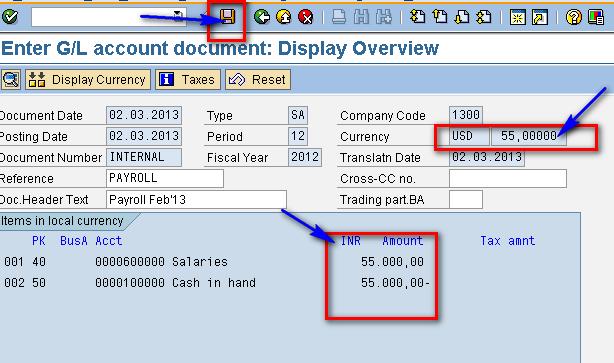

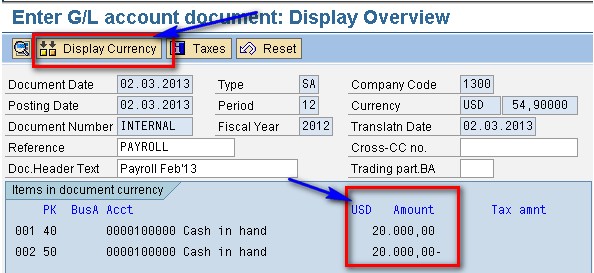

Post one Expenditure Document: (Payroll Posting) under F-02,

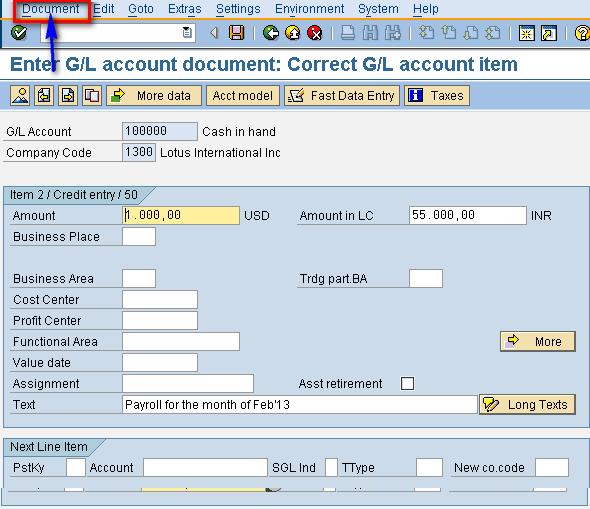

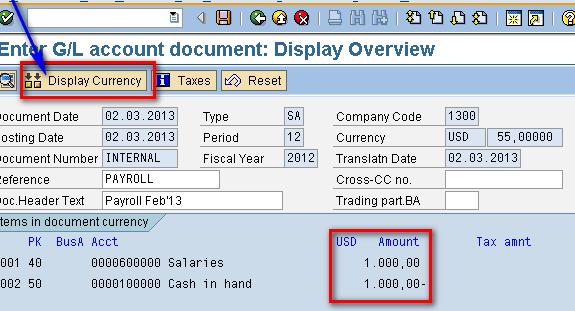

Click on Document⇒ Simulate

Document Currency is in USD

Click on “Display Currency”

- Currency: 55,00 is automatically taken from Forex Table

- Balance is showing in INR after clicking on “Display Currency”

- Click on “Save”

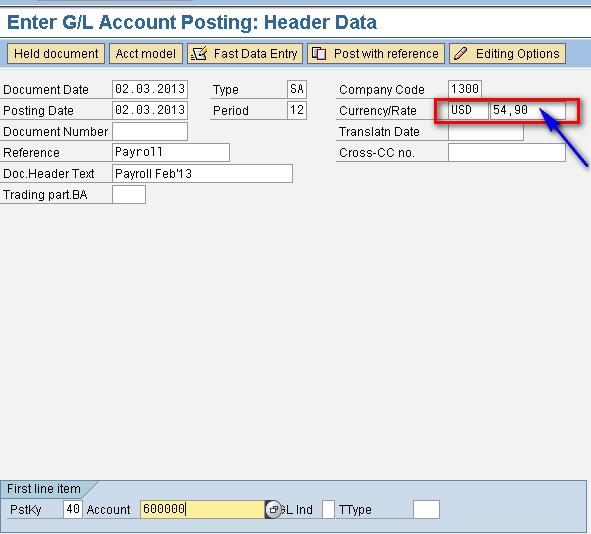

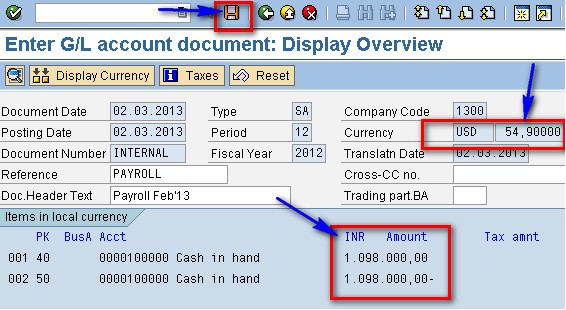

2. When exchange rate is entered at the time of posting the Document:

Post one Expenditure Document: (Payroll Posting) under F-02,

- Enter Exchange Rate

- Press “Enter”

We will get a warning message as below,

- Press “Enter”

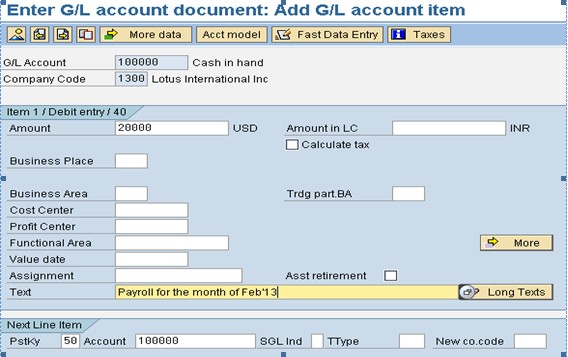

Enter,

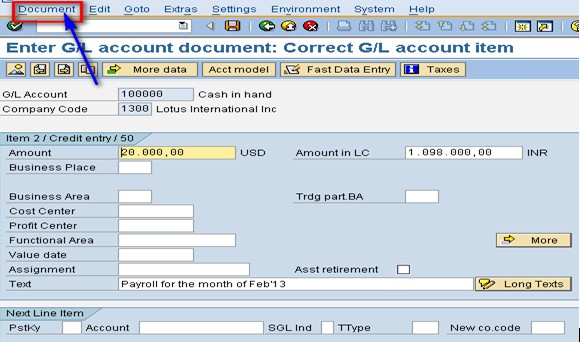

Click on Document⇒ Simulate

Document Currency is in USD

Click on “Display Currency”

- Currency: 54,90 is Manually posted

- Balance is showing in INR after clicking on “Display Currency”

- Click on “Save”

Thankz

Your postings are really very useful.

I grabed very good knowlegeg… thanks..

Most welcome 🙂

If you’ve done office parties or corporate work, make sure

to mention that as well. For more information on my Workshops,

Writing Mastermind Groups and private coaching, please go to my website

listed below and feel free to call me any time.

After you do all this, you are ready to start performing in front of people for money.

Very Detailed Document.

thanq so much sir

Can you tell me on what basis the system take 55 per USD?

Because it is not average rate one thing more if I populate the foreign exchange type like B,G in documents type like DR or KR then populate the FX table with rate of 100 for B or 110 for G and run FAGL_FC_VAL at month end then the system consider these rate seperately for the revaluation of Vendors/Customers or revalue both by using M rate.

Kindly remove my confusion in this regard.

Thanks

Thanks for given in detailed.