The main purpose of Profit center accounting is to determine profit for internal areas of responsibility. By Assigning balance sheet items (Fixed assets,Receivables and Payables, Stocks) to profit centers, we can analyze our company’s fixed asset by profit center. Profit centers can be set up according to product lines, geographical factors (region, offices or production sites) or function (production, sales). We divide our business into profit centers by assigning the profit centers to the various master data (materials, cost centers, orders, projects, Sales orders, assets, cost objects and profitability segments). Every profit center is assigned to the organizational unit controlling area.

Profit Center evaluates the revenues and costs for a particular Project,product line, or a plant or a business unit. Though you can generate balance sheets and profit and loss accounts per Profit Center still a profit center should basically be used as a tool only for internal reporting purposes.

A.� Basic Settings:

⇒Maintain Controlling Area Settings

⇒Create Dummy Profit Center

⇒Set Control Parameters for Actual Data

⇒Maintain Plan Versions

⇒Allow Balances to Be Carried Forward

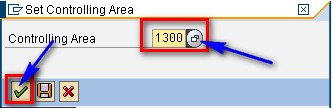

1. set controlling area (OKKS)

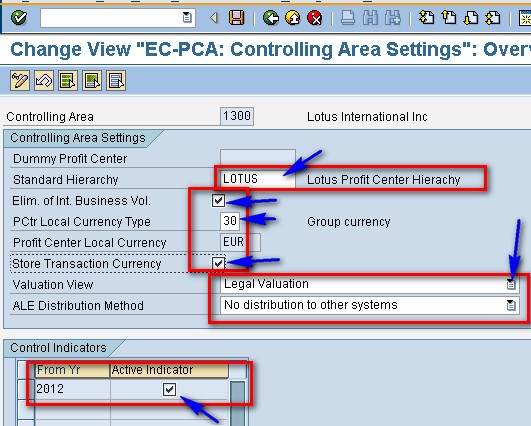

2.maintain controlling area settings(OKE5)

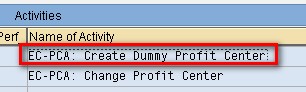

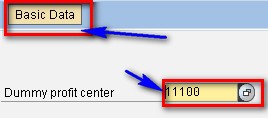

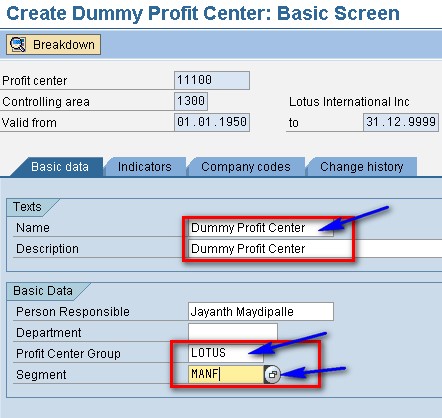

3.create dummy profit center(KE59)

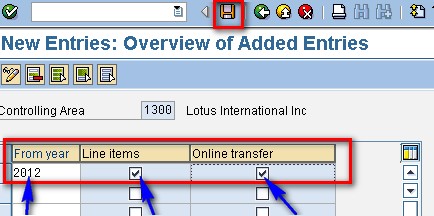

4.set control parameters for actual data(1KEF)

5.maintain plan versions(OKEQ)

6.allow balances to be carried forward(2KET)

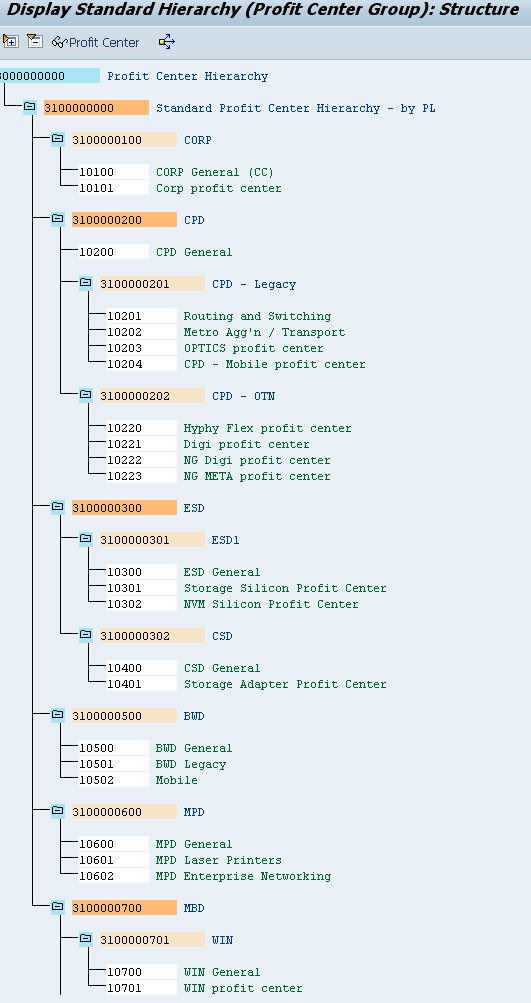

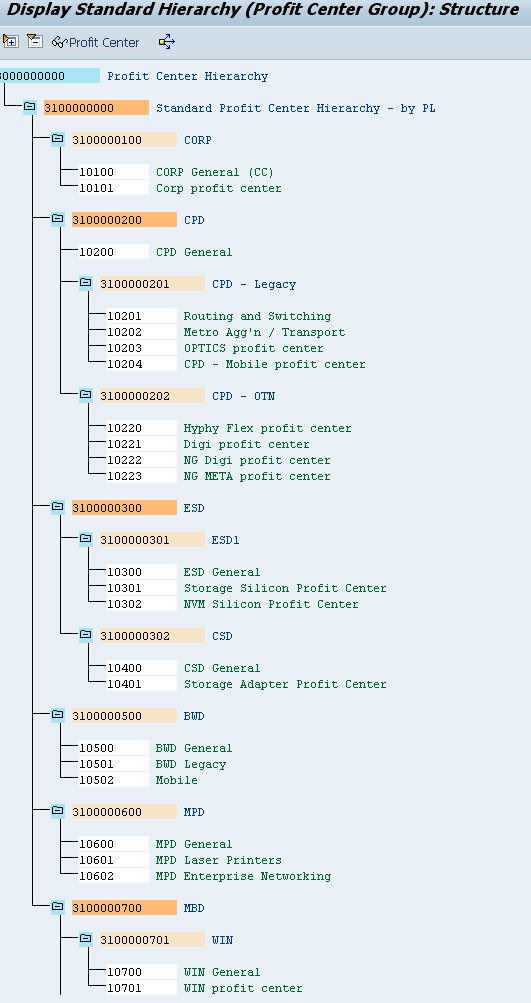

7.maintain standard hierarchy(KCH4 in IMG or KCH1 in Easy Access)

8.Create profit center(KE51)

9.Assignment of profit centers in cost centers(KS02)

10.creation of revenue elements(KA01 or FS00)

11.maintain automatic account assignment of revenue elements(OKB9)

12.defone number ranges for local documents(GB02) both for actual and plan documents.

13.choose additional balance sheet and P&L accounts(3KEH)

Creat/change/display Profit Center-KE51/KE52/KE53.

Profit Center Group Display-KCH3