It’s high time to learn new Finance automation process and accept changes that comes with SAP Leonardo for faster decision making, adaptability, innovation, business acceleration, better outcomes and it keep’s SAP customer’s employees focus on the real job to be done.

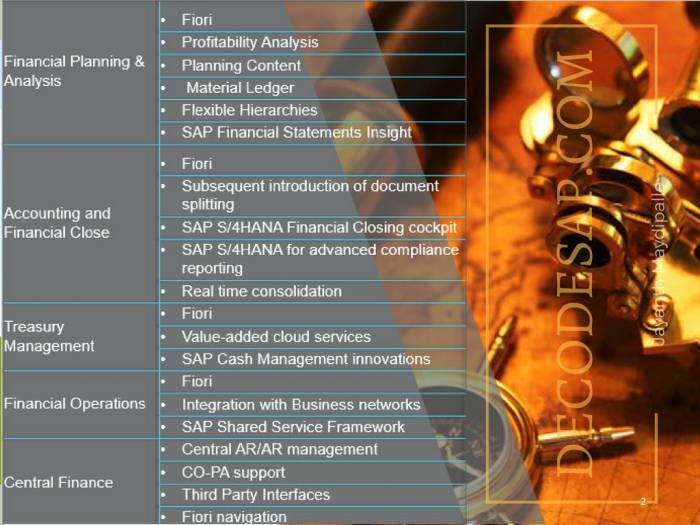

Let’s go through the “Finance – Innovations”

- Universal Journal: Subsequent implementation of document split

- Parallel valuation: 3rd currency in Controlling and Cost of Goods Manufactured.

- Accounting: General ledger document split

- Financial Planning: Basic Sales Planning (Activity Price, Consumption)

- Cash Management: Bank relationship management including bank fee analysis; Improved Integration with Bank Communication Management and In-House Cash

- Machine Learning for Cash Application – Invoice Matching clear incoming payments by matching them with the corresponding receivables

- Soft close and prediction: Minimum closing time; Early insight into business trends

- Integration: Seller-side integration with Ariba Network (invoice and discount management); Cost center (SuccessFactors); Payment advice (Fieldglass); Ariba Pay/ Supply Chain Finance

- Central finance

- Shared Services in Accounts Payables/Receivables

- Central reversal and correction capabilities

- financial reporting scenarios

- SAP Fiori apps Roles

- Accounts Payable/Receivable Accountant

- Accounts Receivable Manager

- Controller (Production Costs, Credit)

- Treasury Risk Manager

- Asset Accountant

- General Ledger Accountant

- Inventory Accountant

TOPIC – 1: UNIVERSAL JOURNAL – SUBSEQUENT INTRODUCTION OF DOCUMENT SPLITTING

To fulfill the IFRS reporting requirements, you need to report your financial data at a lower level of detail than your company code. With this feature, you can introduce new account assignment objects, such as segment or profit center, and add these account assignments to your journal entries when you post them. To ensure that you have a complete reporting view of each account assignment object, the opening balance is enriched and split, per account. The enrichment of relevant accounting data is carried out in the project cockpit, according to the new account assignment information. To ensure correct processing of open items, at the time document splitting is active, this feature allows you to enrich open items.

TOPIC – 2: MACHINE LEARNING – SAP CASH APPLICATION INTEGRATION

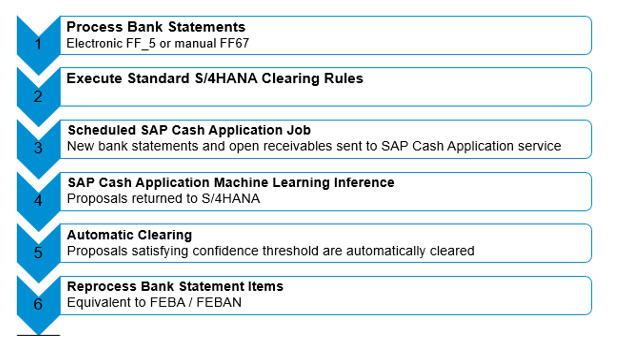

SAP Cash Application is a cloud service that integrates with S/4HANA Cloud Edition as of 1702 and S/4HANA on-premises as of 1709 (hybrid model).

The integration to SAP Cash Application solution intends to automate the invoice-matching process and provide the prediction results back to the SAP S/4HANA system with the help of machine learning.

SAP Cash Application enables you to match open receivables to incoming bank statement items using machine learning.

In the finance area, and more specifically in the area of accounts receivables, incoming bank statement items are ideally matched automatically to open receivables such as invoices. Any manual post-processing of incoming bank statement items that could not be matched to open receivables takes time and effort. SAP Cash Application uses machine learning procedures to train financial applications in order to learn from manual matchings, and thus achieve higher automatic matching rates.

KEY FUNCTIONALITIES OF SAP CASH APPLICATION:

⊕ Proposing open receivables for incoming bank statement items

You can schedule jobs to receive a list of Machine Learning proposals for matching receivables to existing bank statement items

⊕ Clearing incoming bank statement items.

You can schedule jobs to automatically clear incoming bank statement items based on Machine Learning proposals, if the following conditions are met:

- The matching rate of the proposal is higher than specified in the configurations

- The proposed receivables are still open

- All other clearing rules are fulfilled

⊕ Proposing customer accounts for incoming bank statement items

You can schedule jobs to receive a list of Machine Learning proposals for matching accounts to existing bank statement items.

- The matching rate of the proposal is higher than specified in the configurations

- The proposed account is a valid existing account

⊕ Posting incoming bank statement items

You can schedule jobs to automatically post incoming bank statement items to accounts based on Machine Learning proposals.

SAP CASH APPLICATION DETAILED WORKFLOW:

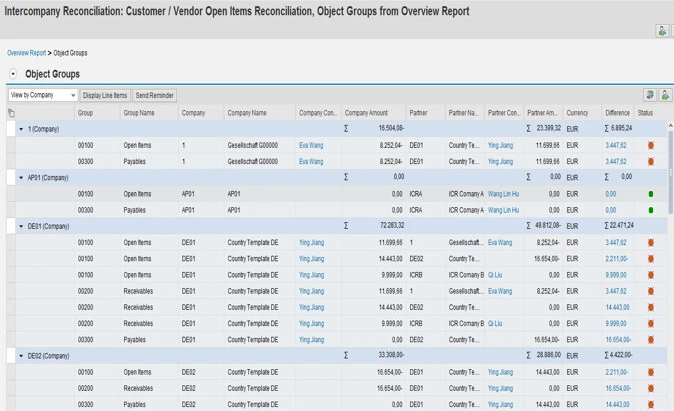

TOPIC – 3: INTERCOMPANY REPORTING

- Shows reconciliation amount and difference in object group for company and its partner

- Drills down to line item details

- Displays detailed information of document

- Shows the reconciliation processing status

- Navigates to reconciliation monitoring page for manual reconciliation

- Sends mail and reminder to contact person

TOPIC – 4: PROFITABILITY ANALYSIS IN THE UNIVERSAL JOURNAL

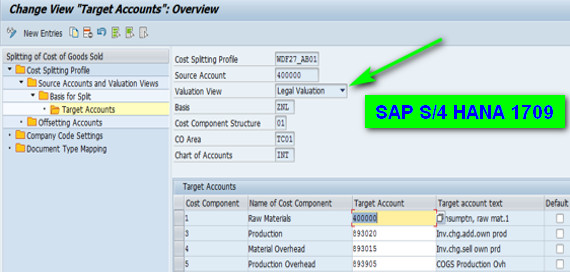

SPLITTING COST OF GOODS SOLD IN SAP S/4HANA

Enhanced functionality enables to split costs of goods sold during more processing such as third party or other processes with account assignment to internal orders or projects

COGS SPLITTING CUSTOMIZING HAS BEEN ADJUSTED

Previous COGS Split functionality which processed the splitting only for goods movements with reference to a sales order is still available

SPLITTING COST OF GOODS SOLD IN SAP S/4HANA 1610 SCREEN AND 1709 SCREEN

TOPIC – 5: MATERIAL VALUATION IN S/4HANA – MATERIAL LEDGER

- Up to 3 currencies

- Tracking historic rates in material master

- Local legal valuation & e.g. hard or trading currency

- Actual Costing

- Optional revaluation of stock and COGS

- Leverage Actual cost component split

Thank You

Jayanth Maydipalle

Source: SAP, JAM, ML, AI and Other.

SAP FINANCIAL CLOSING COCKPIT

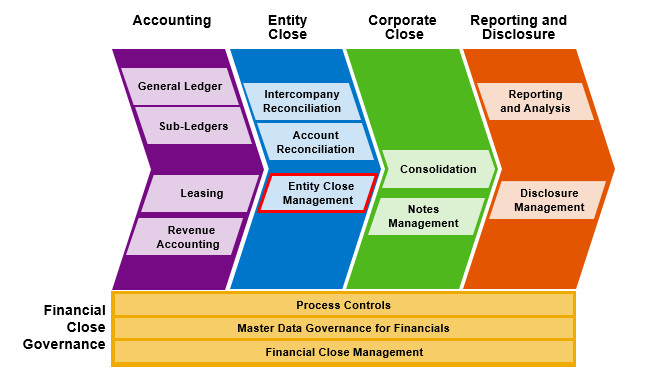

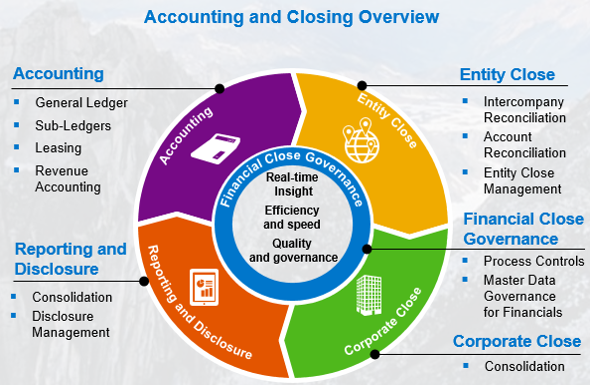

ACCOUNTING AND FINANCIAL CLOSE

SAP’s accounting and financial close solutions streamlines the accounting for multiple companies, currencies, charts of accounts, and reporting standards. The solutions enable finance to efficiently close books on time, and create financial statements at the entity and corporate levels for IFRS, U.S. GAAP, or other local and global requirements.

- SAP offers a modern accounting system for finance teams needing to streamline core financial and closing processes to meet increasingly complex business and disclosure demands.

- It accelerates your company’s path to financial transformation by eliminating boundaries between transactional and analytical processes combined with proven excellence in accounting and closing capabilities.

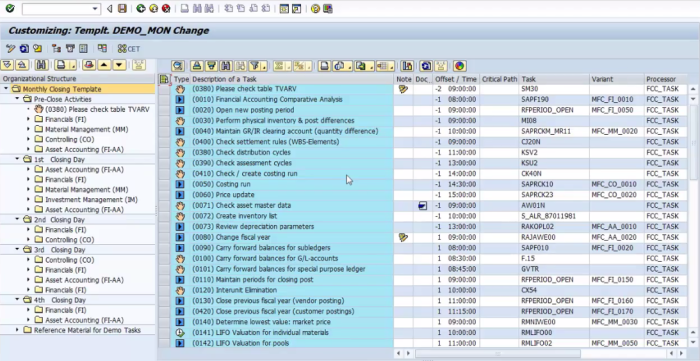

- SAP Financial Closing cockpit = Transactions codes “FCLOCOx“

TOP 10 BENEFITS OF SAP ACCOUNTING AND FINANCIAL CLOSE SOLUTIONS

1. Lower Cost of Finance

Accelerated processes increase productivity and reduce cost. Automate manual steps to reduce staff workloads which lowers the cost of their work and increases productivity.

2. Accelerated Closing

Reduce cycle time via automation, integration and collaboration. Virtual soft close provides better insight at anytime from anywhere. Accelerate accounting by integrating GL, fixed assets, accounts payables, accounts receivables, inventory, revenue, and costs in real-time.

3. Real-Time Business Insight

Enables fast issue resolution and gets you closer to the business. Monitor in real-time the progress, quality, and financial results of the closing cycle to avoid bottlenecks and address business concerns

4. Responsiveness

Closes the gap between insight and action. Achieve fast, multi-dimensional reporting without replicating information to a data warehouse Instant access anywhere with drill-down from the highest to the lowest level of detail.

5. Harmonization

Harmonize internal and external reporting without redundancy. Unify financial, regulatory, managerial and operational data in a single repository across multiple systems. Eliminate redundant data aggregation for easy analysis down to the lowest level of detail. Reduction of memory footprint through elimination of redundancy. Unite OLTP and OLAP together for simplified landscape, processes, and analysis.

6. Seamless Access

Self-service access to transactions and analytics anywhere, at any time. Past, present and future analysis at your fingertips to answer tough questions in briefings and meeting.

7. Modern User Experience

State-of-the-art user experience using the latest technology innovations. Intuitive end user training interfaces and guided processes eliminate complex teaching undertakings. Customize templates for event-driven closing tasks and collaboration.

8. Compliance You Can Count On

Efficiently meet the demands of complex compliance regulations. Generate high-quality financial statements and management reports required by international and local reporting standards.

9. Boundless Extensibility

Unlimited potential to extend system to customer’s specific business needs.

10. Foundation for Finance Transformation and Innovation

A seamless path to your finance transformation. Choose your path towards finance transformation with real-time software available in on-premise, cloud or hybrid options.

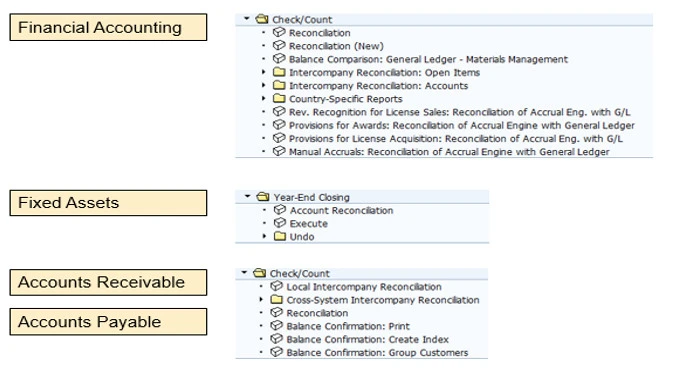

RECONCILIATION FUNCTIONALITY IN SAP ERP

EXECUTE ENTITY CLOSE TASKS

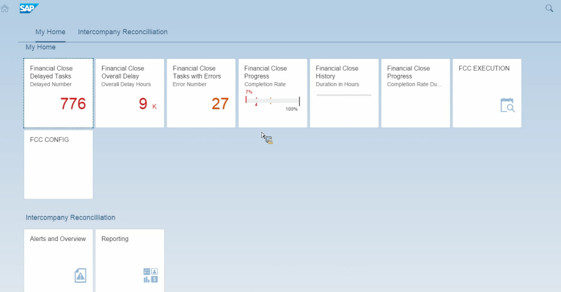

FINANCIAL CLOSING COCKPIT ON FIORI

⊕ Cockpit to monitor the progress of the entity close via KPIs, also on a mobile device

⊕ Analyze the completion rate of closing tasks by multiple dimensions like region, country, company, milestone, working day, etc

⊕ Monitor the tasks delayed or in error with easy collaboration to respective task owners

⊕ Analysis of historic closing cycles

Source : SAP ™