Material Management is the Costing unit for Org, they spent money so each and every activity which spent money should be captured by the Finance People.

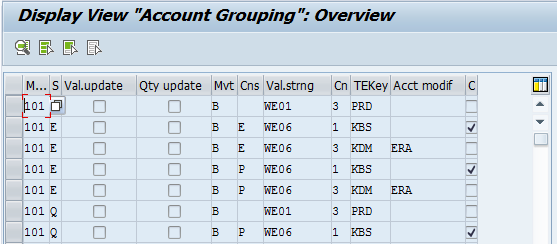

1. Movement Types:

Used to enable the system to find the predefined posting rules determining how the accounts of financial accounting system are to be posted & to update the stock fields in the material master data.(Goods Receipt, Goods Issue, etc)

All Material Movements in MM happens with respect to a Movement type.

Goods Receipt – Movement type-101

Goods issue to production Order- Movement Type-261

Scrapping of Goods- Movement Type-551

Goods Delivered to the customer- Movement Type-601

Initial Upload to Stock- Movement Type-561

Material Master-Valuation class- Movement type-Transaction key

2. Valuation Class:

Every Material will have a Valuation Class field. Valuation class could be Finished goods, Semi finished Goods and Raw Materials etc. Combination of Valuation class+ The Movement types determines the GL accounts.

Type of Valuation Class:

3000 – Raw Materials

7900 – Semi finished Goods

7920 – Finished Goods

Raw material procures with Valuation Class 3000 and go for processing , converted to semifinished product with Valuation Class 7900 and finally Finished products converted with Valuation Class 7920 which you can sale Finished products by creating a sale order(VA01).

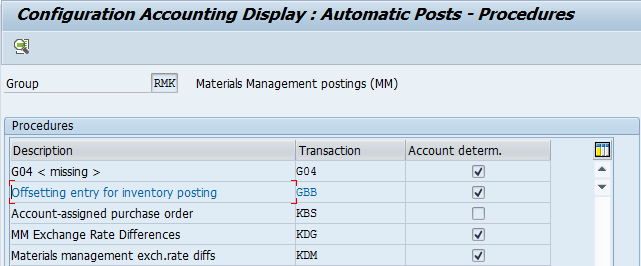

3. Transaction key:

Used to control the storage or filing of documents & assignment of documents.Used to differentiate b/w various transactions such as goods movement that occur in inventory.

BSX – Stock Posting / Inventory Posting

PRD – Price difference

GBB – Offsetting entry for stock posting

WRX – GR/IR Clearing

FRI – Freight Clearing

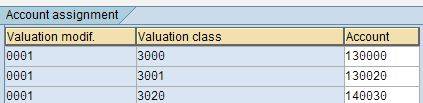

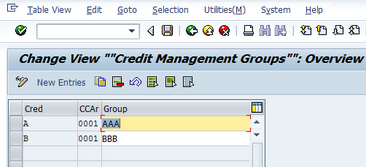

4.Valuation Modifier: Valuation modifier is also called as valuation grouping code. Use OMWM to activate Valuation Grouping code.

OMWD– Assign Valuation Grouping code to Valuation area.

Valuation grouping code is used to group the valuation area to minimize the effort, In SAP using two types of valuation area

1.Company Code, 2. Plant, But the SAP recommends you to use the val;uation area at plant level, because valuation will be differ from one plant to another, if need we can maintain the valuation area at company level also,The valuation grouping code makes it easier to set automatic account determination. Within the chart of accounts,based on our requirement to define individual account determination for certain valuation areas or,to define common account determination for several valuation areas

we can maintain the valuation group code in OMWD for the valuation area as Plant or Company within the chart of account

Note: It is mandatory to maintain Valuation Modifier. As Valuation area cannot be assigned directly to account determinations. Even if you have only one valuation area, it should be assigned to a Valuation Modifier.

5. Material Type:

Each material should assign material type in Material master record used to update whether changes made in Quantity are updated in material master record & change in value also updated in stock account.

ROH: Raw materials are always procured externally and then processed. Since raw materials cannot be sold, a material master record of this material type contains no sales data.

HALB: Semifinished products can be procured externally (sub-contracting) as well as manufactured in-house. They are then processed by the company. A material master record of this material type can contain both purchasing and work scheduling data.

FERT: Finished products are produced by the company itself. Since they cannot be ordered by Purchasing, a material master record of this material type does not contain purchasing data.

DIEN: Services are procured externally and cannot be stored. A material master record of this material type can always contain purchasing data

HAWA: Trading goods are always procured externally and then sold. A material master record of this material type can contain purchasing and sales data.

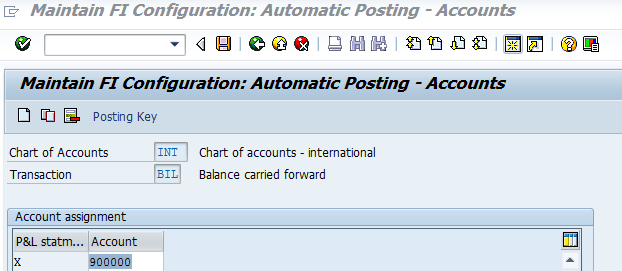

FI-MM: The integration between FI-MM happens in T-code OBYC.

Step1: First you send a Purchase Order to the Vendor.

Here there won’t be any accounting entry as this is simply like telling the Vendor what goods you want, its quantity and the date of delivery etc.,

Step 2: When GR is posted .

When you receive Goods you CAN NOT make the following entry

Inventory A/c Dr To Vendor A/cbecause, some of the goods you have received may be damaged or may not be upto the mark or for any other reason goods may reject, so before posting it to Vendor A/c we keep it in separate place till we verify the goods. And the actual entry will be:

Inventory A/c Dr (Transaction Key BSX @ OBYC)

To GR/IR A/c (Transaction Key WRX @ OBYC)

Here the goods received is Debited to inventory and Credited to a temporary A/c i.e., GR/IR a/c

Step 3: You will post an Invoice to the Goods received.

Here you will post the invoice after you are satisfied with the goods received, the entry will be

GR/IR A/c Dr

To Vendor A/c

Now the goods are moved from GR/IR A/c and Vendor is Credited. Now you got the final entry of Goods to Vendor Account i.e.

Inventory A/c Dr

To Vendor A/c

i.e., Inventory A/c was Debited and Vendor A/c was Credit and GR/IR A/c is Dr and also Credited hence its balance became ‘Zero’, and it has to be Zero always.

Step 4: Payment to Vendor.

Vendor A/c Dr

To Bank Clearing A/c

Step 5: At the time of Bank Statement upload:

Bank Clearing A/c Dr

To Bank Main A/c

http://155.56.92.22/wiki/pages/viewpage.action?pageId=235963558