⇒Define Fiscal Year

⇒Define Posting Periods

⇒Define Field Status Variant

⇒Define Tolerance group for Users

⇒Define Document Types and Assign Number ranges

⇒Define Posting Keys

⇒Assigning all above to Company Code

⇒Define Fiscal Year

A period of usually 12 months, for which the company produces financial statements and takes inventory.

A fiscal year need not correspond to the calendar year. Under certain circumstances, fiscal years containing fewer than 12 months are also permitted (short fiscal year).

Definition:

The fiscal year variant is used to define the fiscal year.

You can define the following using a fiscal year variant:

o How many posting periods are in a fiscal year

o How many special periods you require

o How the system determines the posting periods when posting.

In the definition, you allocate your posting periods to the calendar year.

Allocation control requires the same number of posting periods in the company code and

in the assigned controlling area.

This means that the number of posting periods in the fiscal year variants must be the

same in the company code and in the controlling area. The period limits for the two fiscal

year variants must also coincide.

You must define which fiscal year variant is to be used for each company code. To do

this, you must define the appropriate fiscal year variant (to contain no more than 16

periods).

Fiscal Year

Fiscal Year – Year Independent

Fiscal Year – Year Dependent

Normal and Special Periods

Normal Periods 1 to 12

Special Periods 13 to 16

Open/Close Posting Periods

Define Fiscal Year Variant

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Fiscal year – Fiscal year Variant

T Code : OB29

Steps:

Click ‘New Entries’

1. Select ‘V3’

2. Click ‘Copy as’

3. Change ‘V3’ as ‘SV’

4. SAVE the settings

5. Click ‘Copy all’

6. Press ‘Enter’

7. SAVE

Assign Company Code to Fiscal Year Variant

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Fiscal year – Assign Company Code to Fiscal year Variant

T Code : OB37

Steps:

1. Click ‘Position’

2. Enter Co. Code

3. Enter FYV

4. SAVE the settings

⇒Define Posting Periods

A period within a fiscal year for which transaction figures are updated.

Every transaction that is posted is assigned to a particular posting period. The transaction figures are then updated for this period.

Definition:

This describes the specifications for a posting period (for example, beginning and end).

Each company code refers to exactly one variant. Therefore, as many company codes as you require can use the same variant.

Define Variant for Open Posting Period

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Posting Period – Define Variant for Open Posting Period

T Code : OBBO

Steps:

Click ‘New Entries’

1. Enter 4 digit code

2. Enter Variant Name

3. SAVE the settings

Open and close Posting Periods

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Posting Period – Open and close Posting Periods

T Code : OB52

Steps:

Click ‘New Entries’

1. Enter 4 digit variant

2. Enter ‘+’

3. Enter starting Period

4. Enter Year

5. Enter Ending period

6. Enter year

7. Enter First Spl Period

8. Enter Year

9. Enter End Spl Period

10.Enter Year

11.SAVE the settings

Assign Company Code to Posting Period Variant

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Posting Period – Assign Company Code to Posting period Variant

T Code : OBBP

Steps:

1. Click ‘Position’

2. Enter Co. Code

2. Enter Variant Code

3. SAVE the settings

⇒Define Field Status Variant

Definition:

A field status variant groups together several field status groups. You assign a field status variant to each company code.

The field status group specifies which fields are ready for input, which fields must be filled or which fields are suppressed when entering documents. This specification is known as the field status.

Define Field status Variant

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Line Items –Controls – Maintain field status Variant

T Code : OBC4

Steps:

Click ‘New Entries’

1. Select ‘0001’

2. Click ‘Copy as’

3. Change ‘0001’ as ‘SIVA’

4. SAVE the settings

5. Click ‘Copy all’

6. Press ‘Enter’

7. SAVE

Assign Company Code to Field Status Variant

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Line Items – Controls – Assign Company Code to Field Status Variant

T Code : OBC5

Steps:

1. Click ‘Position’

2. Enter Co. Code

2. Enter Variant Code

3. SAVE the settings

⇒Define Tolerance group for Users

An accepted deviation from specified values. With reference to the key, tolerances for the entry of documents and the granting of cash discounts can be determined for all employees

of the group for payment settlement.

Define Tolerance Group for Users

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Line Items – Controls – Define Tolerance group for Users

T Code : OBA4

Steps:

Click ‘New Entries’

1. Enter Co. Code

2. Enter Currency ‘INR’

3. Enter Max Amount

4. Enter Amount

5. Enter Percentage

6. Enter Amount

7. Enter Percentage

8. SAVE

⇒Define Document Types

The document type classifies accounting documents. It is noted in the document header.

Attributes that control the entry of the document or which are themselves stored in the document are stipulated for each document type. In particular, the number range assigned to the relevant documents is determined on the basis of the document type.

Define Document Types

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Document Header – Define Document Types

T Code : OBA7

Steps:

Click ‘New Entries’

1. Enter Doc Type

2. Define No. range

3. Define Rev Doc type

4. Define A/c type

5. Select Control fields

6. Select req fields

7. SAVE the settings

⇒Define Assign Number ranges

Number which identifies the number range for the number assignment.

The process by which numbers are allocated to business objects.

There are two types of number assignment:

o Internal number assignment occurs automatically in the R/3

System.

o External number assignment is performed either by the user or an

external system.

Define Number Ranges for Document Types

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Document Header – Define Document Types

T Code :OBA7

Steps:

1. Double click ‘Doc Type’

2. Click ‘No. range info’

3. Enter Co. code

4. Click ‘Change Interval’

5. Click ‘Insert Interval’

6. Enter Sl No.

7. Enter Year

8. Enter From No.

9. Enter To No.

10. SAVE the settings

⇒Define Posting Keys

Definition:

The posting key describes the type of transaction which is entered in a line item.

For every posting key, you specify properties which control the entry of the line item or are noted in the line item itself.

The most important properties which are derived from the posting key are:

o The account type

o The allocation to the debits or credits side

o The possible or necessary specifications which are to be entered in the line item.

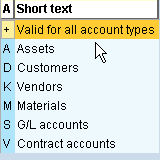

Account Type

key that specifies the accounting area to which an account belongs.

Examples of account types are:

o Asset accounts

o Customer accounts

o Vendor accounts

o G/L accounts

The account type is required in addition to the account number to identify an account, because the same account number can be used for each account type.

Posting Keys and Account Types

Define Posting Keys

Menu Path: IMG – Financial Accounting – Financial Accounting Global Settings – Documents – Line Items – Controls – Define Posting Keys

T Code : OB41

Steps:

1. Click ‘Create’

2. Enter Posting Key

3. Define Key Name

4. Define Debit/Credit

5. Define A/c type

6. SAVE the settings

1st row of the above screen shows we have entered +. Here + represents allowed for types of accounts. In the subsequent rows we have entered specific account types.

1st row of the above screen shows we have entered +. Here + represents allowed for types of accounts. In the subsequent rows we have entered specific account types.